- Median sales price reached a record $380,000 despite declining sales

- June inventory up 9.8 percent, a second consecutive year-over-year increase

- Softer demand led to longer days on market, up 5.0 percent to 21 days, on average

(July 18, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, Twin Cities home prices rose as sellers continued receiving strong offers despite slightly longer market times. Meanwhile, buyers signed 18.4 percent fewer purchase agreements than last year. While these signal a rebalancing marketplace, the persistent shortage of homes in the region should keep prices resilient.

Home Prices & Sales

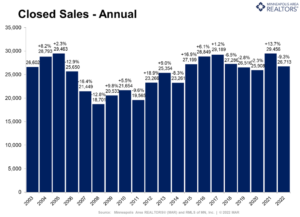

The median home price hit a record $380,000 last month, an 8.6 percent increase from last June and a 23.4 percent increase since the beginning of the pandemic in June of 2020. For the last few years, historically low mortgage rates have offset the effect of rising prices on monthly payments. With rates recently moving from under 3.0 percent to 5.5 percent, the impact of rising prices has increased monthly payments. “While buyers should know that mortgage rates are still well below their long-term average, the increase in rates has had a real impact,” said Denise Mazone, President of Minneapolis Area REALTORS®. “Today’s buyers are more sensitive to that.” Indeed, the housing affordability index reached its lowest level since at least 2004. Buyers signed 5,544 purchase agreements last month, 18.4 percent fewer than last June. That’s the lowest June figure since 2014. But, the decline can be misleading because it’s compared to a uniquely strong market last year. Comparing to pre-pandemic levels, June closings were down just 3.6 percent from June 2019.

Inventory & Listings

A silver lining of moderating buyer activity is its effect on the inventory shortage throughout the region. The metro ended June with 8,020 homes for sale, 9.8 percent more than last June. Inventory gains have been rare, but with a mere 1.6 month’s of supply, buyers are thirsty for more choices. “It’s reassuring to see more homes on the market after a few years of under 2.0 months of supply,” according to Mark Mason, President of the Saint Paul Area Association of REALTORS®. “That said, the gain came mostly from fewer buyers and not more sellers, so we still need more supply and more building activity to balance out the market.” While the Twin Cities saw demand weaken, seller activity was more stable. New listings were down 6.7 percent from last year, with 7,901 homes coming on the market. But relative to June 2020, seller activity increased 4.4 percent.

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 12.1 percent while existing home sales were down 15.1 percent. Single family sales fell 13.8 percent, condo sales declined 24.5 percent and townhome sales were down 15.1 percent. Sales in Minneapolis decreased 21.7 percent while Saint Paul sales fell 15.8 percent. Cities like Rogers, Minnetrista, and Waconia saw the largest sales gains while New Richmond, Apple Valley, and Farmington had lower demand than last year.

June 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 7,901 properties on the market, a 6.7 percent decrease from last June

- Buyers signed 5,544 purchase agreements, down 18.4 percent (6,422 closed sales, down 15.4 percent)

- Inventory levels grew 9.8 percent to 8,020 units

- Month’s Supply of Inventory rose 23.1 percent to 1.6 months (4-6 months is balanced)

- The Median Sales Price rose 8.6 percent to $380,000

- Days on Market rose 5.0 percent to 21 days, on average (median of 8 days, up 14.3 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 13.8 percent; Condo sales were down 24.5 percent & townhouse sales fell 15.1 percent

- Traditional sales declined 15.2 percent; foreclosure sales rose 39.1 percent; short sales were up 100.0 percent (from 4 to 8)

- Previously owned sales decreased 15.1 percent; new construction sales decreased 12.1 percent